Follow:

Recents

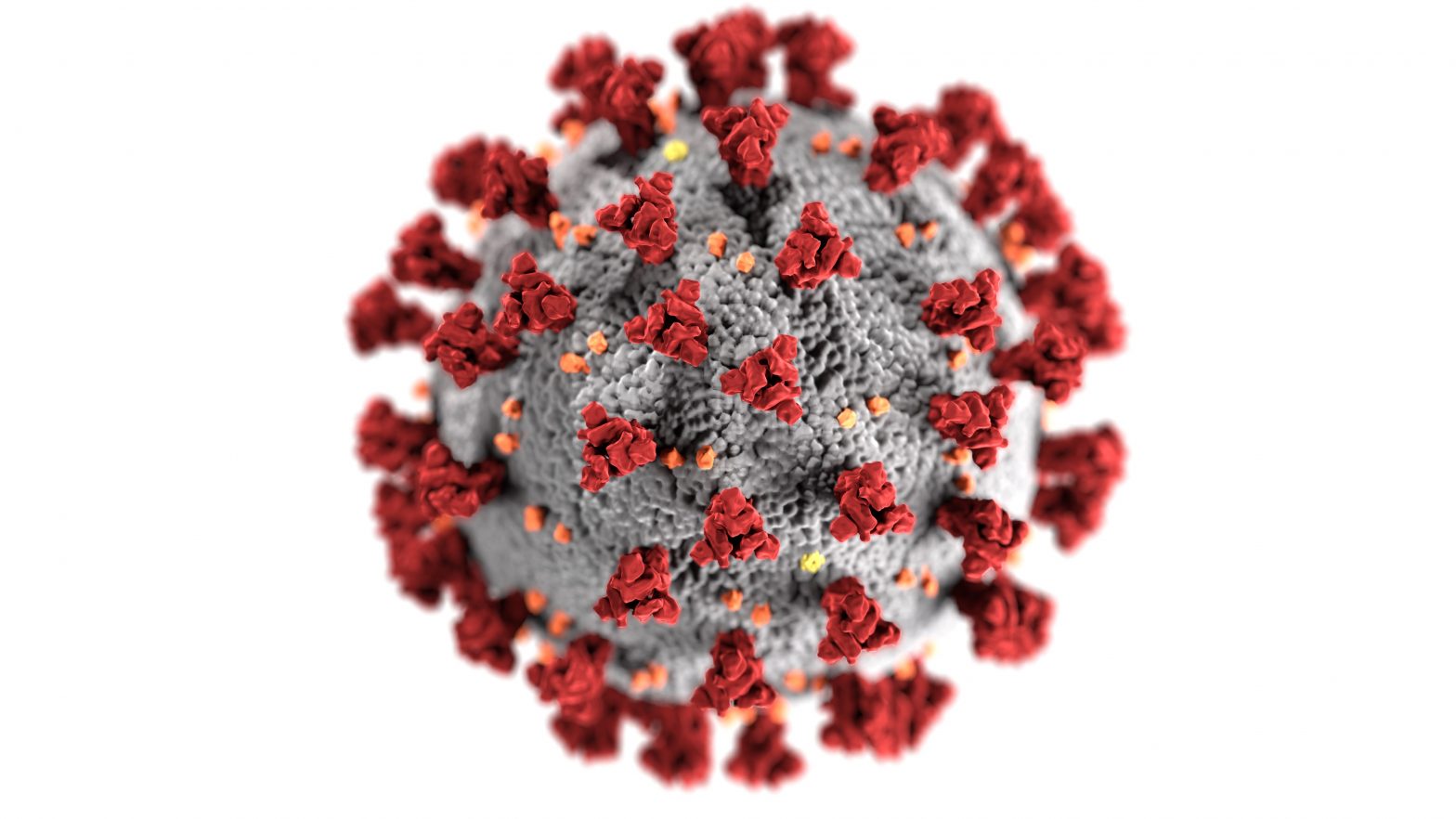

Covid-19

What Your Business Should Know about the Families First Coronavirus Response Act

Covid-19

What Your Business Should Know about the Families First Coronavirus Response Act

Covid-19

COVID-19 HOUSEHOLD PLAN

Covid-19

Telemedicine: An Option to Help Stop the Spread of COVID-19

Covid-19

What Employers Should Know to Fight Coronavirus

What Your Business Should Know about the Families First Coronavirus Response Act

On Wednesday night, March 18, President Trump signed the Families First Coronavirus Response Act to bring much needed relief to an uncertain American workforce. This bill addresses amendments to Family Medical Leave Act (FMLA), as well as paid sick leave due to COVID-19. Both the paid Family Medical Leave Act (FMLA) and paid sick leave provisions apply to private employers with fewer than 500 employees. Under the new Families First Coronavirus Response Act, concerns for both employers and employees are addressed.

Amendments to FMLA

- Eligible employees are those who have been employed for at least 30 calendar days by the employer with respect to whom leave is requested.

- Employers will be required to offer 12 weeks of paid family leave for employees who have been employed for at least 30 days with a minor child in the event of the closure of the child’s school or place of care. The first 10 days are unpaid, but the employee can overlap this with the 10 days of paid sick leave.

- The paid leave benefit can be no more than $200 per day and an aggregate amount of $10,000. The paid family leave credit offsets 100% of employer costs for providing mandated paid family leave.

Paid Sick Leave for COVID-19

Employers will provide paid sick time in the event that the employee is unable to work due to:

- The employee being quarantined or isolated by the order of federal or state authority.

- The employee has been advised by a health care provider to self-quarantine.

- The employee is experiencing symptoms of COVID–19 and is seeking a medical diagnosis.

- The employee is caring for an individual who is subject to the order as described above.

- The employee is caring for a child if the school or place of care of the child has been closed or the childcare provider of the child is unavailable.

- Full-time employees will be entitled to up to 80 hours of paid sick leave.

- Part-time employees will be entitled to their average number of hours worked over a two-week period.

- Employers must offer two weeks (10 days) of paid sick leave for COVID-19-related reasons. If the sick leave is for an employee who is sick or seeking a diagnosis, the benefit must replace all the employee’s wages up to a maximum benefit of $511 per day.

- If an employee is caring for another individual who is sick, the benefit must replace at least two-thirds of the employee’s wages up to a maximum benefit of $200 per day.

- The paid sick leave credit offsets 100% of employer costs for providing mandated paid sick leave. The credit also offsets, uncapped, the employer contribution for health insurance premiums for the employee for the period of leave.

- The credit also offsets, uncapped, the employer contribution for health insurance premiums for the employee for the period of leave.

- Self-employed individuals will be provided refundable income tax credits in an amount of what self-employed workers would have received if they had been an employee receiving paid leave benefits pursuant to the mandates. For any given day that a self-employed worker could not work, they can claim a “rough justice” tax credit in the amount of their average daily self-employment income for the year.

How are employees paid for FMLA and Paid Sick Leave?

Under the FMLA amendment, when family leave is necessary, the employer can provide the first 10 days of leave unpaid, then subsequent absences for this reason must be paid at 2/3 the employee’s regular rate of pay. The Act includes a cap of $200 a day and $10,000 cumulative. If the first 10 days are unpaid, an employee may elect to substitute any accrued vacation leave, personal leave, or medical/sick leave for the unpaid leave. Paid sick leave for COVID-19 is paid at the employee’s regular rate, but it is capped at $511 per day.

When do these changes take effect and for how long?

Both the proposed FMLA changes and the proposed paid sick leave take effect not later than 15 days after enactment and would remain in place until December 31, 2020.

Who pays for the sick time or leave?

The employer pays the employee benefits; however, the employer will receive a tax credit for doing so.

Is the paid sick leave in addition to current leave provided by the employer?

Congress removed a provision in the original bill that would have prevented employers from changing their current policies and benefits in response to the act; however, an employer may not require an employee to use other paid leave provided by the employer before the employee uses the paid sick leave available under this act.

At what rate is the paid sick leave accrued?

The entire 80 hours of paid sick leave is available to the employee immediately.

Which employees are eligible for these benefits?

Eligible employees are those who have been employed for at least 30 calendar days.

What notice must an employee provide for leave?

The FMLA provisions require employees to provide the employer with “notice of leave as is practicable.” The paid sick leave provisions state that after the first workday (or portion thereof) that an employee receives paid sick leave, an employer may require the employee to follow reasonable notice procedures in order to continue receiving the paid sick leave.

Does the 500-employee requirement refer to a location or company-wide?

The company (not just the location) must have fewer than 500 employees.

Is carryover required for unused emergency paid sick leave?

The paid sick provisions state that unused paid sick leave does not carry over from one year to the next.

Must an employer pay out unused emergency paid sick leave if the employee separates from its employment?

An employer is not required to pay unused paid sick leave if an employee separates from employment.

Are employers with 500 or more employees obligated to provide paid sick or leave benefits?

They have no such obligation under this bill. However, they still must comply with obligations under state or local paid sick leave or paid family and medical leave laws and administer sick or paid time off or paid leave provided under company policies or collective bargaining agreements.

If you are an employer and have further questions about Families First Coronavirus Response Act, please call the Global Group at (847) 837. 3037 or email info@globalgroupinc.com.