Follow:

Recents

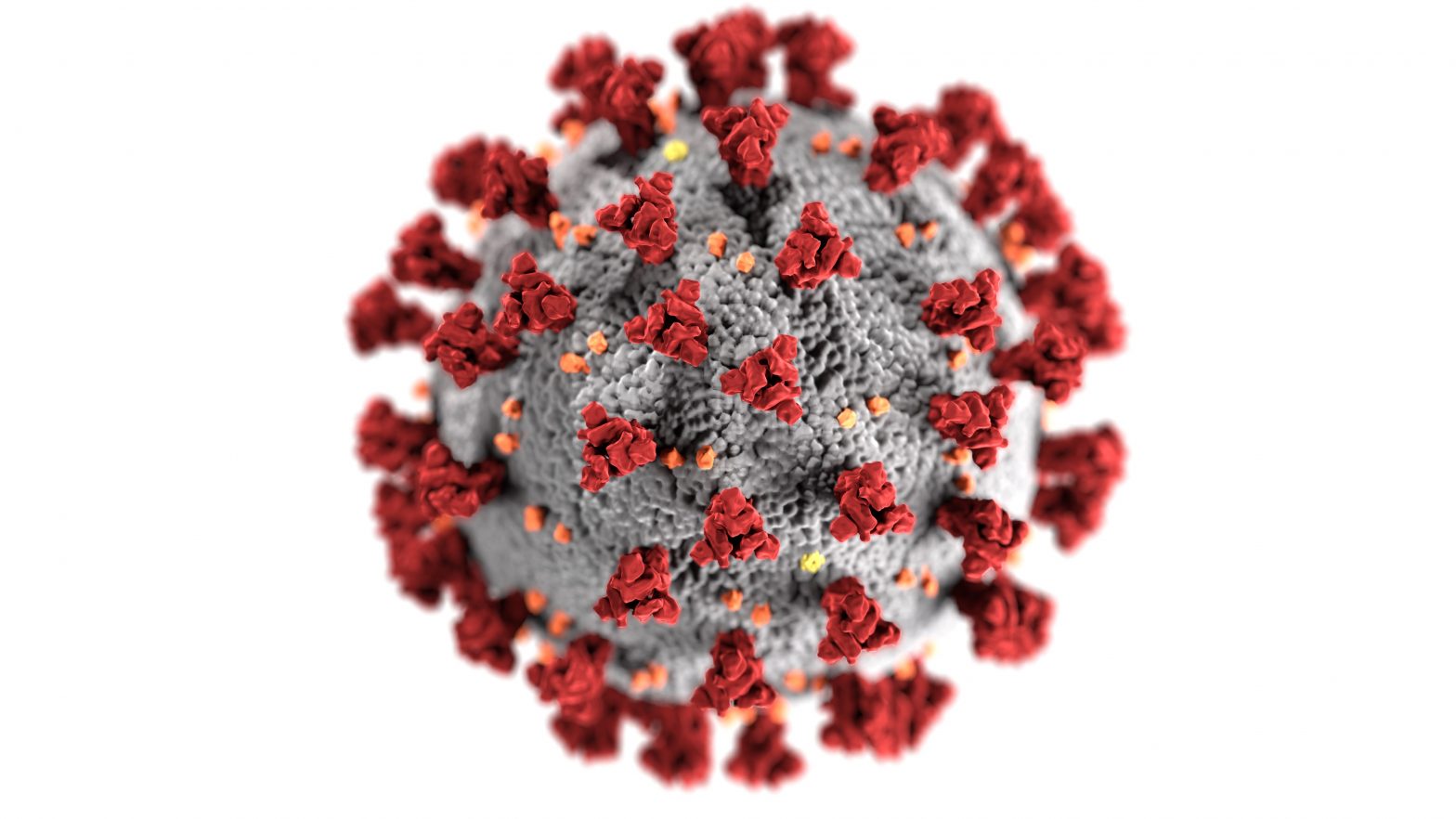

Covid-19

What Your Business Should Know about the Families First Coronavirus Response Act

Covid-19

What Your Business Should Know about the Families First Coronavirus Response Act

Covid-19

COVID-19 HOUSEHOLD PLAN

Covid-19

Telemedicine: An Option to Help Stop the Spread of COVID-19

Covid-19

What Employers Should Know to Fight Coronavirus

Why is Financial Wellness an Important Employee Benefit?

Ask anyone to explain basic finances and they can. Despite this, most people struggle to save enough money for things like retirement, emergencies, and homes. Financial wellness services and savings plans are one of the most sought after benefits a company can offer.

Consumer debt is growing at an alarming rate. The Federal Reserve reported consumer debt in the first quarter of 2-18 totaled $3.86 billion. As of April 2019, consumer debt totaled just under $4.07 billion. The rate of consumer debt keeps increasing month after month and year after year.

This debt is a mix of revolving and non-revolving. Student loans, car loans, credit cards, and mortgages account for much of this debt. In order to repay this debt, choices have to be made. Do you pay for things like life insurance, emergencies, and retirement? Is it better to pay off the debt first and then focus on them?

Can You and Your Employees Pass the Financial Literacy Quiz?

In a CNBC story, it was found that 21% of working Americans do not save for retirement, emergencies, and other situations. Even those that are saving for retirement are not saving enough. The recommendation is to save 10 to 20%, but less than 2 out of 10 people are saving enough.

Bankrate asked people why they weren’t saving. The number one answer was the ratio of expenses to income. High schools and colleges don’t really delve into the realities of financial planning in the future. They don’t talk to students about the money you’ll need to retire, and the factors, such as a chronic health condition, that can impact how much money you need after retirement.

The Financial Industry Regulatory Authority has an online financial literacy quiz people can take to check their financial literacy skills. Four out of 10 people who take this quiz fail to get more than three questions right. How well do you and your employees do?

Why is Financial Wellness a Sought-After Employment Benefit?

Financial uncertainty puts a lot of stress on your shoulders. If your workers are stressed, that stress can impact their immune system and emotional well-being. Workers who are stressed and unhappy may miss work or make mistakes when they are at work. Happy employees are more productive.

In an ideal financial wellness picture, retirement savings is always the first priority. Companies work with their employees to help them achieve their financial goals through benefits like health savings accounts and 401k retirement plans. There are also tools your HR department can offer to help with this.

Goals and Priorities Planning Worksheet – This worksheet helps employees narrow down their immediate financial goals. It’s a good place to list things like paying off student loans. Put the goal, the time frame to complete it in, and how to make that happen.

Debt Reduction Worksheet – With a debt reduction worksheet, your employees can list all of the debt they have. They break it down by amount owed, current interest rate, and monthly minimum payment. Using this sheet, they can prioritize which loans to pay off first and how much they should pay in order to pay it off faster.

Net Worth Worksheet – Knowing exactly how much the debt to income ratio is can help with goal planning. It takes the employee’s income, all monthly payments, and any savings. From there, employees can figure out how much money they have left over each month after bills. That money can then go into retirement and emergency savings.

Retirement Planning Worksheet – Experts say you’ll need 80 percent of your current yearly income each year of your retirement. The worksheet helps workers figure out how much they’d need when they reach retirement age and breaks it down to help them decide how much they need to save in order to reach that target amount.

Spending Worksheet – Putting all the numbers together, employees can track their actual spending and savings contributions to what they wanted to do. It can help them see where they made mistakes or what their prior financial estimates overlooked.

Those are just a few examples of the things you should have available for your employees. Many HR departments simply don’t have the time to help. Between completing payroll, hiring new employees, and keeping up with benefits, your administrative staff may not be able to help or even understand how best to help.

That’s where Global Benefits Group can help. Let our specialists help you and your employees with a full range of financial services. We can help you find the right 401k plans and other financial services that have the lowest fees and put the most money in your accounts at the end of the day. Schedule your complimentary demo today. We’re also available 24/7 via live chat if you have questions or would like to learn more about our services.